options(repr.plot.width = 12, repr.plot.height = 6)EX 10.2

z <- scan("tourist.txt")

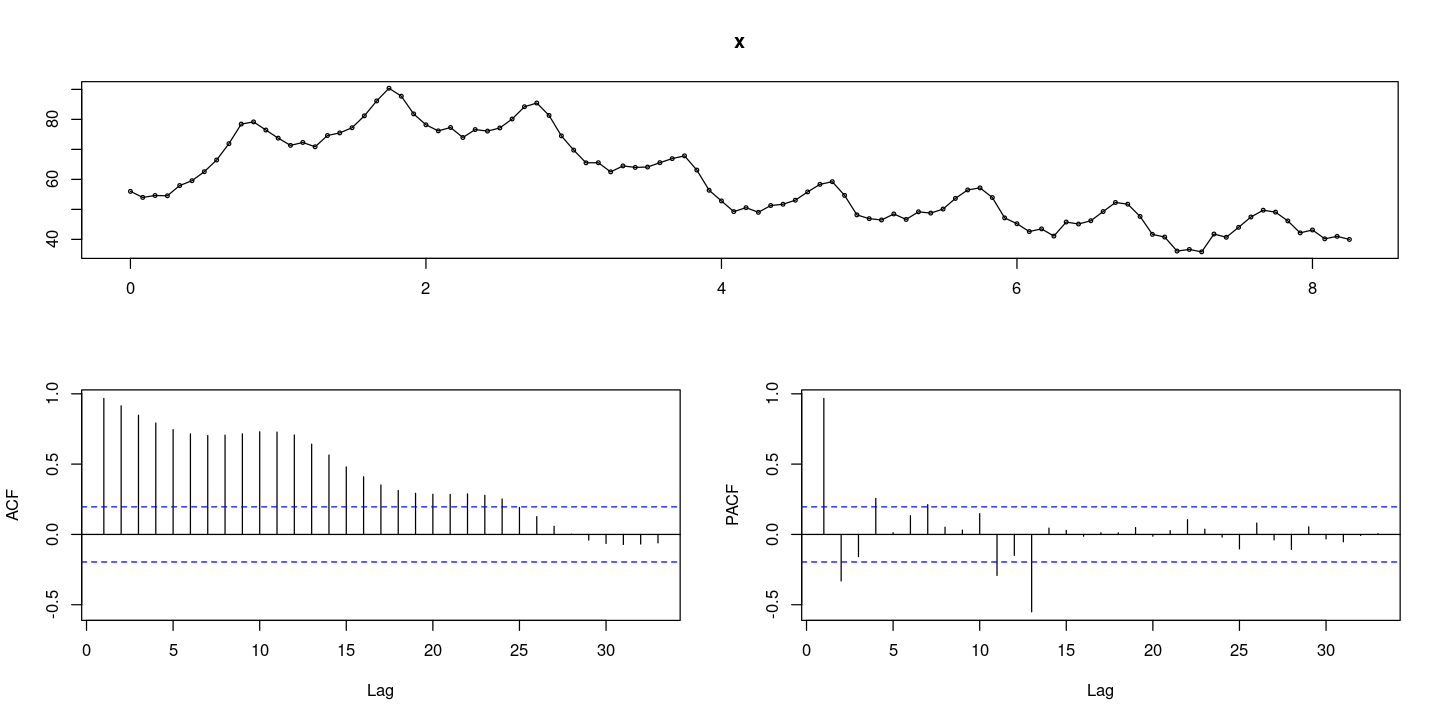

forecast::tsdisplay(z)Registered S3 method overwritten by 'quantmod':

method from

as.zoo.data.frame zoo

이분산성, 추세와 계절성분을 모두 가지고 있다.

변수변환을 통한 분산안정화 부터 진행

ACF천천히 감소(계절성분이 있어서 봉긋하게 솟아오르는 그림: 계절차분 필요해)

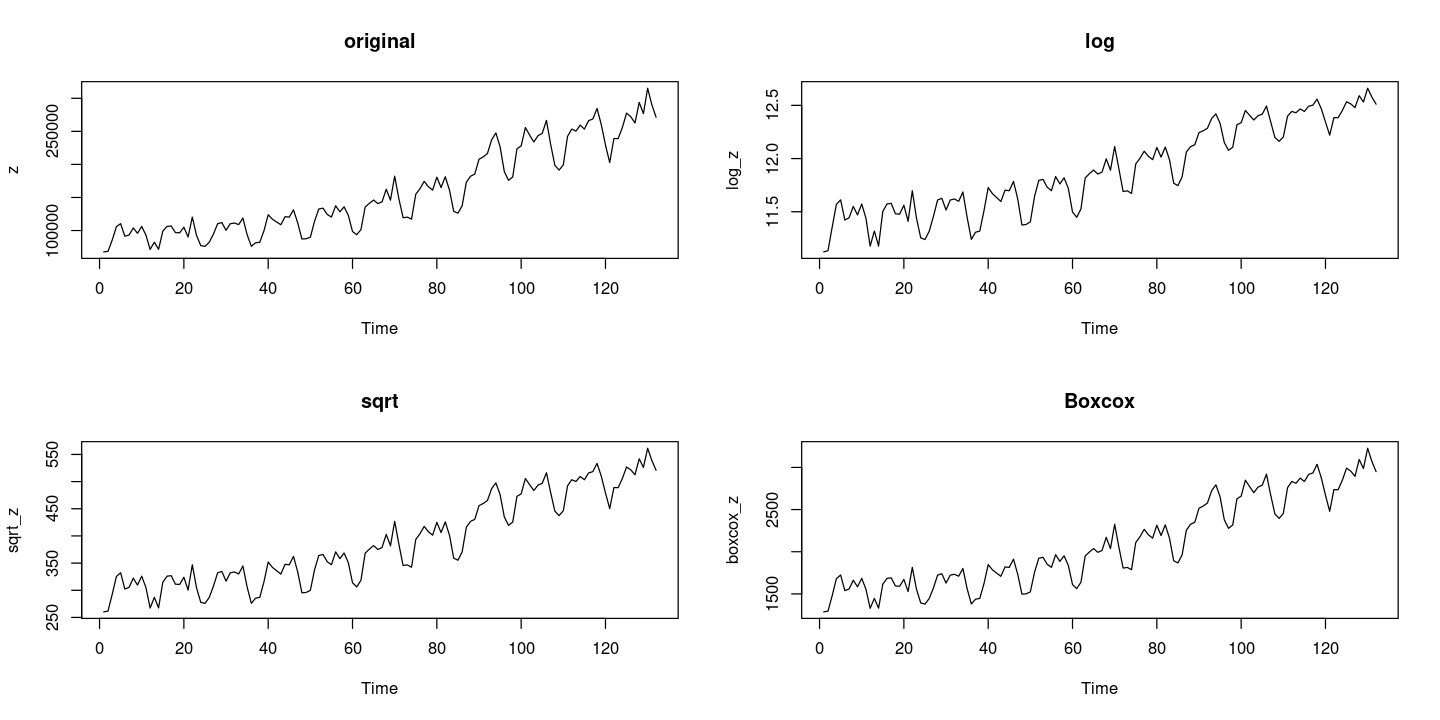

(1) 분산안정화 : 변수변환

log_z = log(z)

sqrt_z = sqrt(z)

boxcox_z = forecast::BoxCox(z,lambda= forecast::BoxCox.lambda(z))forecast::BoxCox.lambda(z)par(mfrow=c(2,2))

plot.ts(z, main = "original")

plot.ts(log_z, main = 'log')

plot.ts(sqrt_z, main = 'sqrt')

plot.ts(boxcox_z, main = 'Boxcox')

t = 1:length(z)

lmtest::bptest(lm(z~t)) #H0 : 등분산이다

lmtest::bptest(lm(log_z~t))

lmtest::bptest(lm(sqrt_z~t))

lmtest::bptest(lm(boxcox_z~t))

studentized Breusch-Pagan test

data: lm(z ~ t)

BP = 1.574, df = 1, p-value = 0.2096

studentized Breusch-Pagan test

data: lm(log_z ~ t)

BP = 5.4539, df = 1, p-value = 0.01953

studentized Breusch-Pagan test

data: lm(sqrt_z ~ t)

BP = 0.26821, df = 1, p-value = 0.6045

studentized Breusch-Pagan test

data: lm(boxcox_z ~ t)

BP = 0.026422, df = 1, p-value = 0.8709원데이터도 등분산이긴 하지만.. sqrt나 boxcox를 하는게 나은 것 같다.

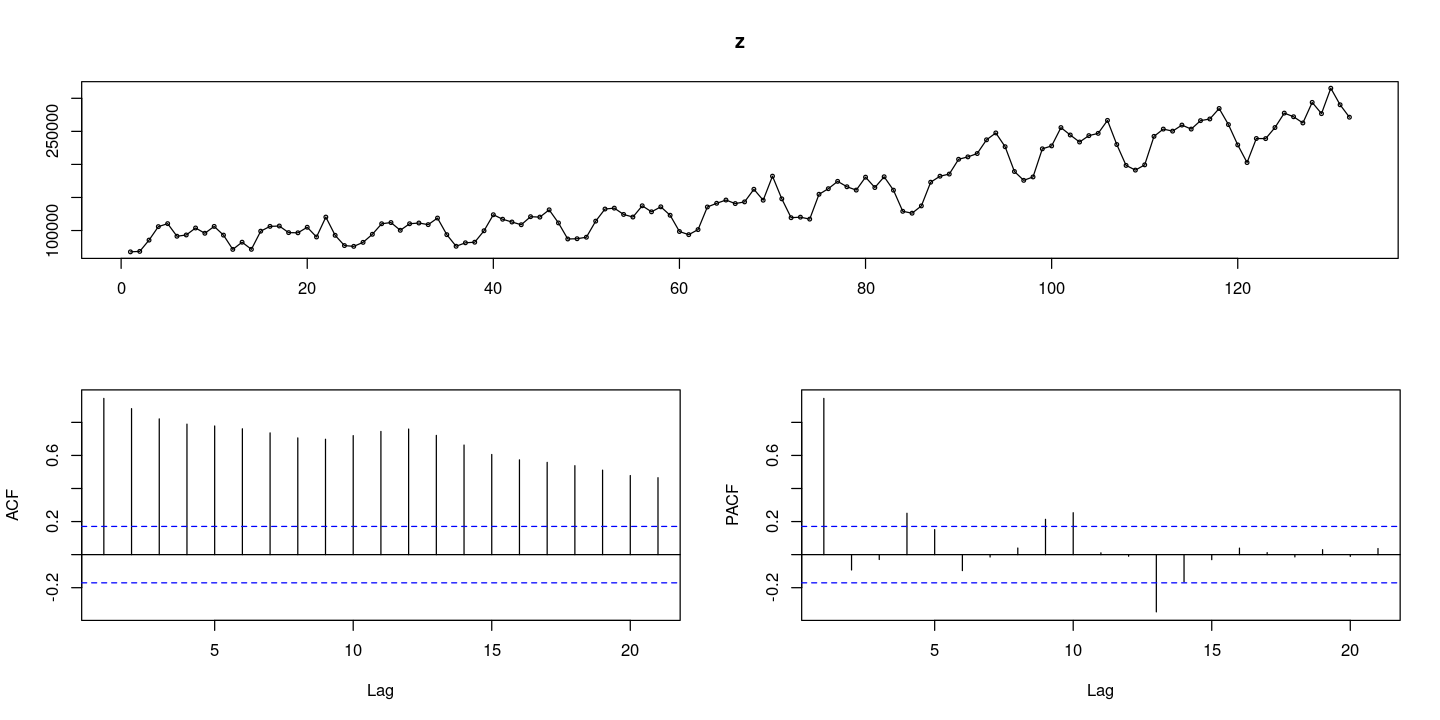

\(\lambda = 0.597\)을 이용한 Boxcox 변환 수행

forecast::tsdisplay(boxcox_z)

- 계절성분과 추세가 존재하므로 우선 계절차분을 통한 계절성분 제거

(2) 계절차분

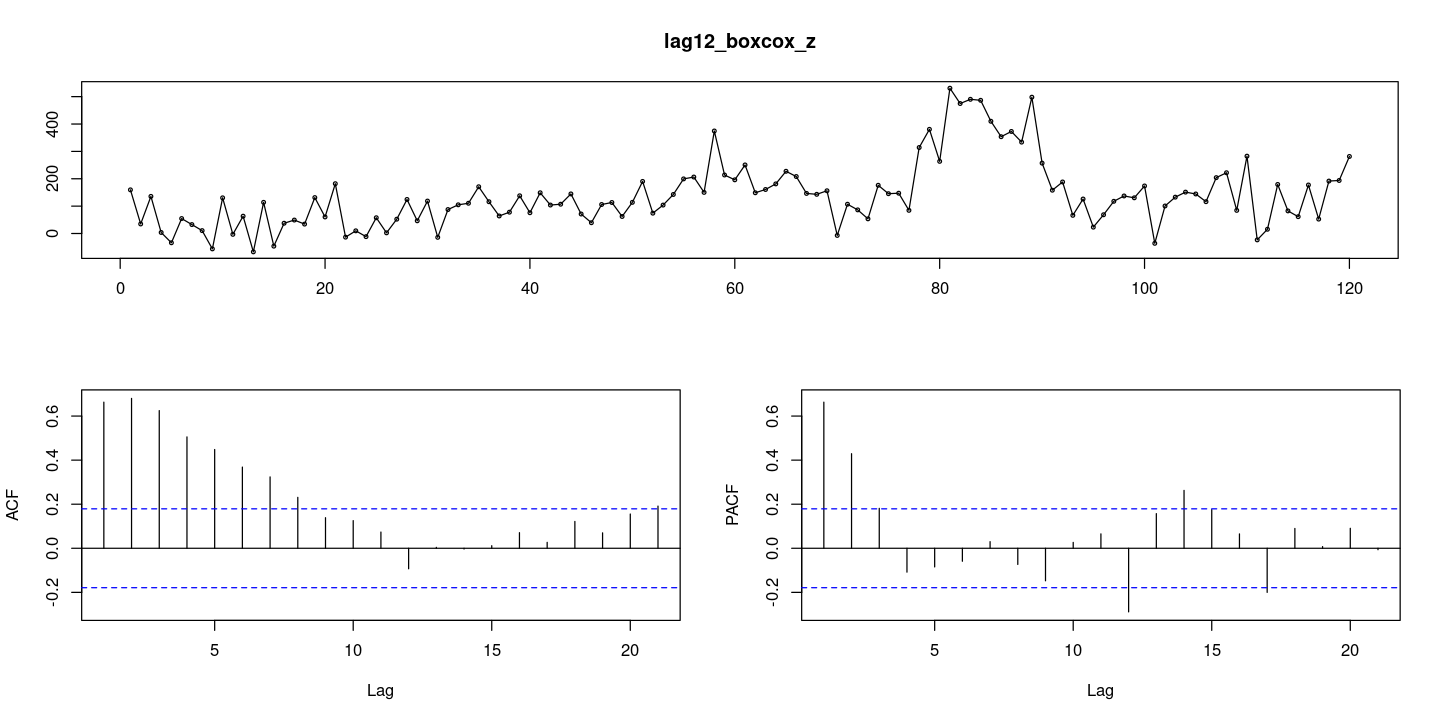

lag12_boxcox_z = diff(boxcox_z, lag=12)

forecast::tsdisplay(lag12_boxcox_z)

계절차분을 통해 결정적 계절추세는 제거 되었음

결정적 추세는 없는 것으로 보이나, ACF가 조금은 천천히 감소하는 경향이 보이기 때문에 단위근 검정을 통해 차분이 필요한가에 대한 여부 판정

평균

t.test(lag12_boxcox_z)

One Sample t-test

data: lag12_boxcox_z

t = 12.508, df = 119, p-value < 2.2e-16

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

116.3801 160.1566

sample estimates:

mean of x

138.2684 - 평균 0아님

(3) 단위근 검정

##단위근 검정 : H0 : 단위근이 있다.

fUnitRoots::adfTest(lag12_boxcox_z, lags = 1, type = "c")

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 1

STATISTIC:

Dickey-Fuller: -2.6696

P VALUE:

0.08535

Description:

Tue Dec 5 20:44:51 2023 by user: - 유의확률이 아주 크지는 않지만, 유의수준 \(\alpha=0.05\)하에서 귀무가설을 기각하지 못하기 때문에 차분을 하기로함, 단위근이 있어!

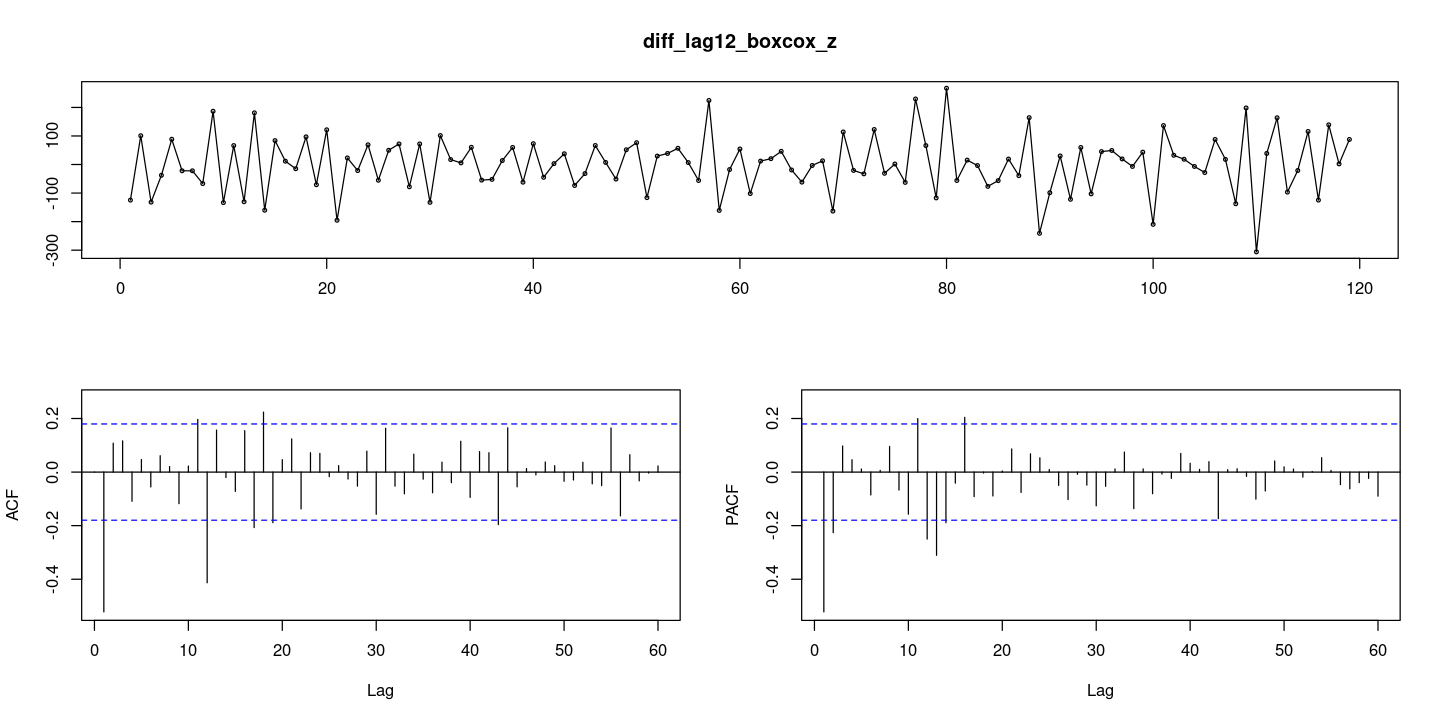

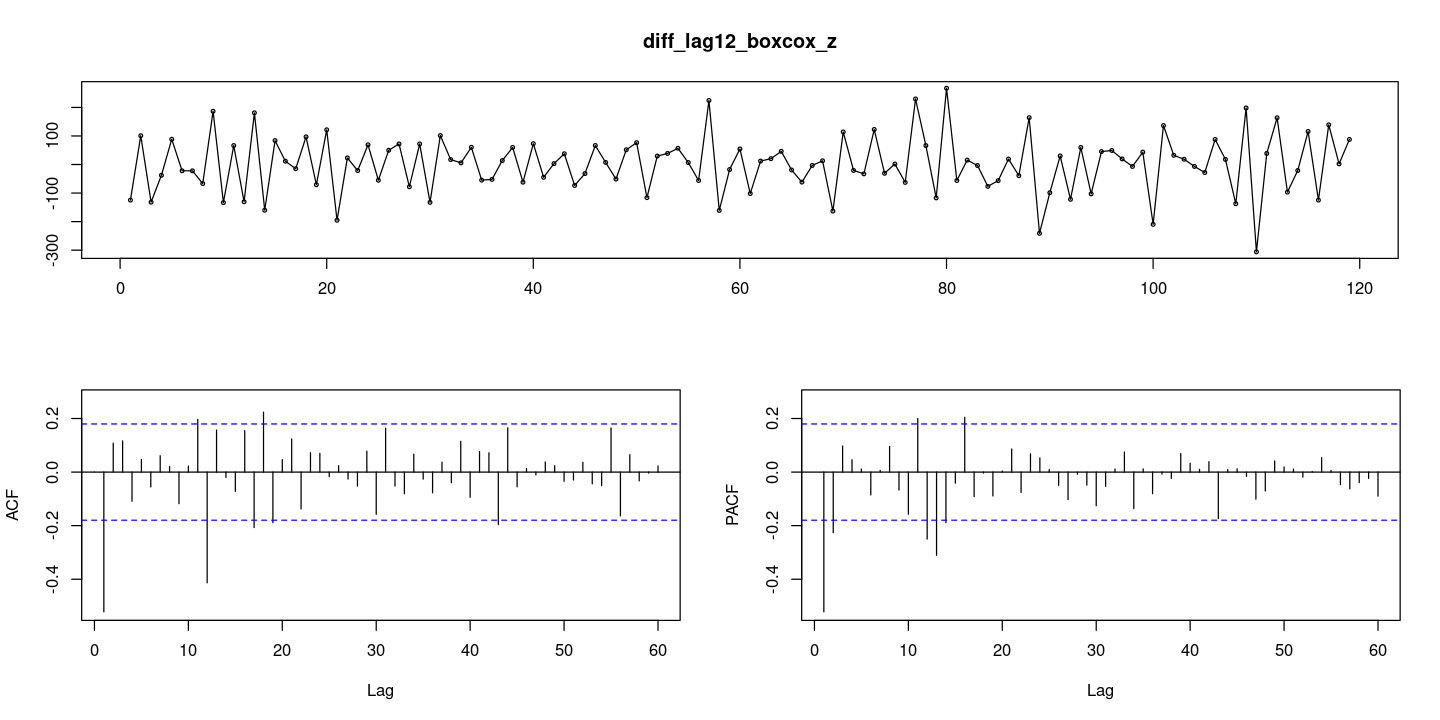

diff_lag12_boxcox_z = diff(lag12_boxcox_z)

forecast::tsdisplay(diff_lag12_boxcox_z, lag.max=60)

- 차분한 후의 자료에 대해서는 더이상 차분이 필요하지 않음

(4) 모형식별

forecast::tsdisplay(diff_lag12_boxcox_z, lag.max=60)

ACF는 1차와 12차에서 절단 형태이고, PACF는 1,2차와 12,13 시차 등에서 유의하게 나왔다.

ACF의 차수가 더 낮으므로 MA(1)과 계절형 MA(1)모형을 적합할 수 있다.

diff_lag12_boxcox_z = : \(ARIMA(0, 0, 1)(0, 0, 1)_{12}\)

lag12_boxcox_z = \(ARIMA(0,1,1)(0,0,1)_{12}\)

Boxcox_z = \(ARIMA(0,1,1)(0,1,1)_{12}\)

계절형 AR도 괜찮을 것 같다.

(5) 모형적합

- 상수항 추가 여부 확인

t.test(diff_lag12_boxcox_z)

One Sample t-test

data: diff_lag12_boxcox_z

t = 0.11301, df = 118, p-value = 0.9102

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-16.93470 18.98455

sample estimates:

mean of x

1.024925 - 상수항 추가 안해두 된당.

- 모형1

fit11 = arima(diff_lag12_boxcox_z, order = c(0,0,1), include.mean=F,

seasonal = list(order = c(0,0,1), period=12))

fit11

Call:

arima(x = diff_lag12_boxcox_z, order = c(0, 0, 1), seasonal = list(order = c(0,

0, 1), period = 12), include.mean = F)

Coefficients:

ma1 sma1

-0.5307 -0.6370

s.e. 0.0702 0.0842

sigma^2 estimated as 4831: log likelihood = -676.87, aic = 1359.74- 모형2

fit12 = arima(lag12_boxcox_z, order = c(0,1,1),

seasonal = list(order = c(0,0,1), period=12))

fit12

Call:

arima(x = lag12_boxcox_z, order = c(0, 1, 1), seasonal = list(order = c(0, 0,

1), period = 12))

Coefficients:

ma1 sma1

-0.5307 -0.6370

s.e. 0.0702 0.0842

sigma^2 estimated as 4831: log likelihood = -676.87, aic = 1359.74- 모형3

fit1 = arima(boxcox_z, order = c(0,1,1),

seasonal = list(order = c(0,1,1), period=12))

fit1

Call:

arima(x = boxcox_z, order = c(0, 1, 1), seasonal = list(order = c(0, 1, 1),

period = 12))

Coefficients:

ma1 sma1

-0.5307 -0.6370

s.e. 0.0702 0.0842

sigma^2 estimated as 4831: log likelihood = -676.87, aic = 1359.74- 위의 3개 모형의 값은 동일하게 나온다.

lmtest::coeftest(fit1) #원데이터에 적합하는게 좋다.(forecast하기 위해서)

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ma1 -0.530740 0.070154 -7.5654 3.868e-14 ***

sma1 -0.637038 0.084175 -7.5680 3.790e-14 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1- 모든 계수가 유의하다.

\((1 − B)(1 − B^{12})BoxCox(Z) = (1 − 0.5307B)(1 − 0.6370B^{12})ε_t, ε+t ∼ WN(0, 4831)\)

- MA부분, SMA부분이 있다.

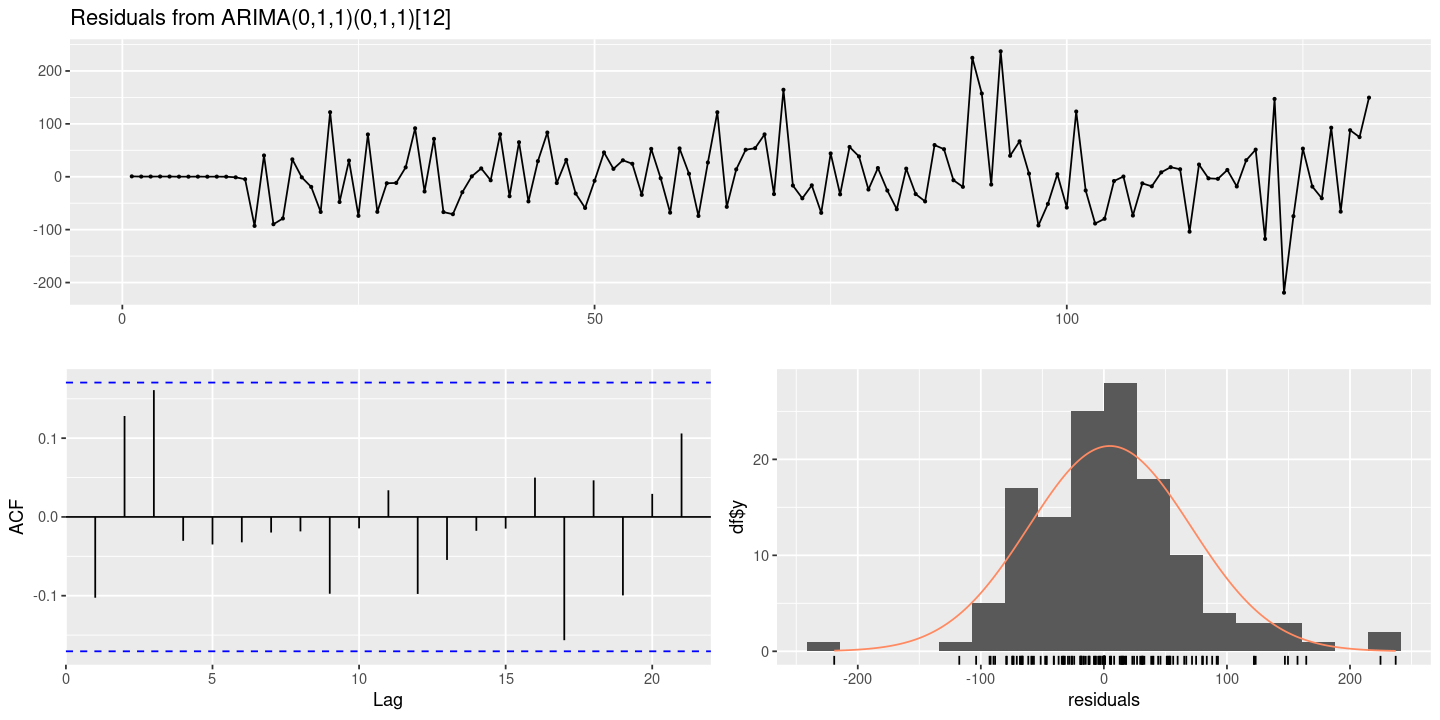

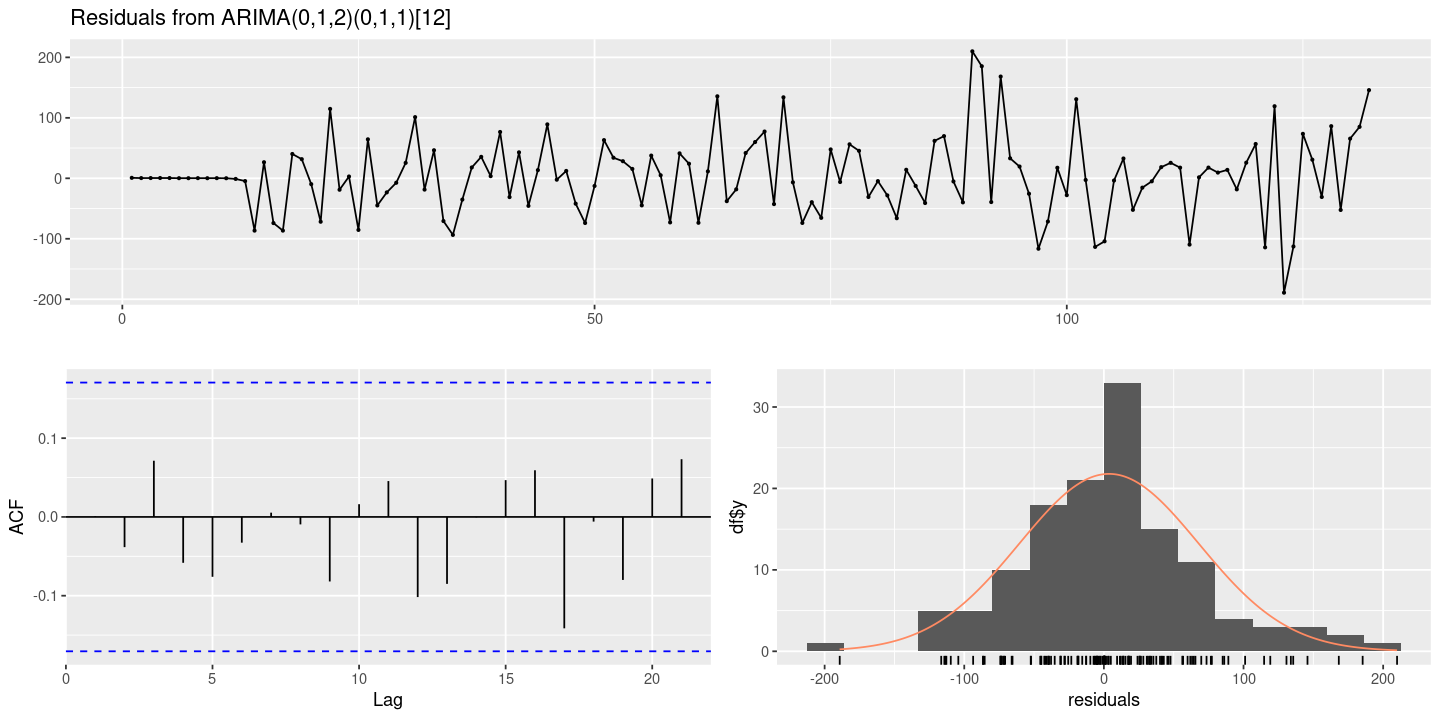

(6) 잔차분석

forecast::checkresiduals(fit1)

Ljung-Box test

data: Residuals from ARIMA(0,1,1)(0,1,1)[12]

Q* = 9.1519, df = 8, p-value = 0.3296

Model df: 2. Total lags used: 10

- 잔차의 평균은 0이다

t.test(resid(fit1))

One Sample t-test

data: resid(fit1)

t = 0.83993, df = 131, p-value = 0.4025

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-6.546096 16.206445

sample estimates:

mean of x

4.830174 - 등분산성을 만족하고, ACF가 모든 시차에서 유의하지 않으므로 WN라고 할 수 있다.

- 포투맨투검정

#모형 적합도 검정 : H0 : rho1=...=rho_k=0

Box.test(resid(fit1), lag=1, type = "Ljung-Box")

Box.test(resid(fit1), lag=6, type = "Ljung-Box")

Box.test(resid(fit1), lag=12, type = "Ljung-Box")

Box-Ljung test

data: resid(fit1)

X-squared = 1.4198, df = 1, p-value = 0.2334

Box-Ljung test

data: resid(fit1)

X-squared = 7.6505, df = 6, p-value = 0.2648

Box-Ljung test

data: resid(fit1)

X-squared = 10.729, df = 12, p-value = 0.5523- 모든 시차에 대해 유의확률값이 크기 때문에 WN라고 할 수 있다.

# 잔차의 포트맨토 검정 ## H0 : rho1=...=rho_k=0

portes::LjungBox(fit1, lags=c(6,12,18,24))| lags | statistic | df | p-value | |

|---|---|---|---|---|

| 6 | 7.650531 | 5 | 0.1765764 | |

| 12 | 10.728871 | 11 | 0.4662493 | |

| 18 | 15.730829 | 17 | 0.5429906 | |

| 24 | 25.724146 | 23 | 0.3140605 |

(7) 과대적합

boxcox_z = \(ARIMA(0,1,1)(0,1,1)_{12}\)

\(ARIMA(1,1,1)(0,1,1)_{12}, ARIMA(0,1,2)(0,1,1)_{12}\)

\(ARIMA(0,1,1)(1,0,1)_{12}\)

- AR추가

fit2 <- arima(boxcox_z, order = c(1,1,1),

seasonal = list(order = c(0,1,1), period=12))

fit2

Call:

arima(x = boxcox_z, order = c(1, 1, 1), seasonal = list(order = c(0, 1, 1),

period = 12))

Coefficients:

ar1 ma1 sma1

-0.3345 -0.2984 -0.6183

s.e. 0.1354 0.1299 0.0828

sigma^2 estimated as 4658: log likelihood = -674.51, aic = 1357.01lmtest::coeftest(fit2)

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ar1 -0.334453 0.135431 -2.4695 0.01353 *

ma1 -0.298389 0.129851 -2.2979 0.02157 *

sma1 -0.618253 0.082802 -7.4666 8.228e-14 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1- MA추가

fit3 <- arima(boxcox_z, order = c(0,1,2),

seasonal = list(order = c(0,1,1), period=12))

fit3

Call:

arima(x = boxcox_z, order = c(0, 1, 2), seasonal = list(order = c(0, 1, 1),

period = 12))

Coefficients:

ma1 ma2 sma1

-0.6445 0.2825 -0.6236

s.e. 0.0871 0.1009 0.0833

sigma^2 estimated as 4569: log likelihood = -673.44, aic = 1354.88lmtest::coeftest(fit3)

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ma1 -0.644484 0.087127 -7.3970 1.393e-13 ***

ma2 0.282478 0.100937 2.7985 0.005133 **

sma1 -0.623576 0.083259 -7.4896 6.908e-14 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1- 계절형 AR

fit4 <- arima(boxcox_z, order = c(0,1,1),

seasonal = list(order = c(1,1,0), period=12))

fit4

Call:

arima(x = boxcox_z, order = c(0, 1, 1), seasonal = list(order = c(1, 1, 0),

period = 12))

Coefficients:

ma1 sar1

-0.5583 -0.5525

s.e. 0.0670 0.0804

sigma^2 estimated as 5011: log likelihood = -678.13, aic = 1362.25lmtest::coeftest(fit4)

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ma1 -0.558307 0.067012 -8.3315 < 2.2e-16 ***

sar1 -0.552549 0.080366 -6.8754 6.181e-12 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1fit1

Call:

arima(x = boxcox_z, order = c(0, 1, 1), seasonal = list(order = c(0, 1, 1),

period = 12))

Coefficients:

ma1 sma1

-0.5307 -0.6370

s.e. 0.0702 0.0842

sigma^2 estimated as 4831: log likelihood = -676.87, aic = 1359.74- AIC가 제일 작은 모형 선택

- \(ARIMA(0,1,2)(0,1,1)_{12}\)모형 적합 결과가 더 좋기 때문에 최종 모형으로 선택

forecast::checkresiduals(fit3)

Ljung-Box test

data: Residuals from ARIMA(0,1,2)(0,1,1)[12]

Q* = 3.3401, df = 7, p-value = 0.8519

Model df: 3. Total lags used: 10

#모형 적합도 검정 : H0 : rho1=...=rho_k=0

Box.test(resid(fit3), lag=1, type = "Ljung-Box")

Box.test(resid(fit3), lag=6, type = "Ljung-Box")

Box.test(resid(fit3), lag=12, type = "Ljung-Box")

Box-Ljung test

data: resid(fit3)

X-squared = 0.00013728, df = 1, p-value = 0.9907

Box-Ljung test

data: resid(fit3)

X-squared = 2.3206, df = 6, p-value = 0.888

Box-Ljung test

data: resid(fit3)

X-squared = 5.1674, df = 12, p-value = 0.9522- 잔차검정 결과도 이상이 없으므로 fit3을 최종모형으로 선택

fit3

Call:

arima(x = boxcox_z, order = c(0, 1, 2), seasonal = list(order = c(0, 1, 1),

period = 12))

Coefficients:

ma1 ma2 sma1

-0.6445 0.2825 -0.6236

s.e. 0.0871 0.1009 0.0833

sigma^2 estimated as 4569: log likelihood = -673.44, aic = 1354.88\((1-B)(1-B^{12})Z_t = (1 -0.6445 B + 0.2825 B^2)(1-0.6236 B^{12}) \epsilon_t\)

부호 반대인거 조심!

(8) auto.arima

forecast::auto.arima(ts(boxcox_z, frequency=12),

test = "adf",

seasonal = TRUE, trace = T)

ARIMA(2,1,2)(1,1,1)[12] : 1357.774

ARIMA(0,1,0)(0,1,0)[12] : 1432.23

ARIMA(1,1,0)(1,1,0)[12] : 1360.54

ARIMA(0,1,1)(0,1,1)[12] : 1359.953

ARIMA(2,1,2)(0,1,1)[12] : 1358.211

ARIMA(2,1,2)(1,1,0)[12] : 1359.268

ARIMA(2,1,2)(2,1,1)[12] : 1359.649

ARIMA(2,1,2)(1,1,2)[12] : 1358.941

ARIMA(2,1,2)(0,1,0)[12] : 1394.751

ARIMA(2,1,2)(0,1,2)[12] : 1358.288

ARIMA(2,1,2)(2,1,0)[12] : 1359.606

ARIMA(2,1,2)(2,1,2)[12] : 1361.251

ARIMA(1,1,2)(1,1,1)[12] : 1356.533

ARIMA(1,1,2)(0,1,1)[12] : 1357.41

ARIMA(1,1,2)(1,1,0)[12] : 1357.649

ARIMA(1,1,2)(2,1,1)[12] : Inf

ARIMA(1,1,2)(1,1,2)[12] : Inf

ARIMA(1,1,2)(0,1,0)[12] : 1393.906

ARIMA(1,1,2)(0,1,2)[12] : 1357.164

ARIMA(1,1,2)(2,1,0)[12] : Inf

ARIMA(1,1,2)(2,1,2)[12] : 1359.974

ARIMA(0,1,2)(1,1,1)[12] : 1354.324

ARIMA(0,1,2)(0,1,1)[12] : 1355.231

ARIMA(0,1,2)(1,1,0)[12] : 1355.507

ARIMA(0,1,2)(2,1,1)[12] : 1356.055

ARIMA(0,1,2)(1,1,2)[12] : 1355.119

ARIMA(0,1,2)(0,1,0)[12] : 1391.769

ARIMA(0,1,2)(0,1,2)[12] : 1354.951

ARIMA(0,1,2)(2,1,0)[12] : 1355.984

ARIMA(0,1,2)(2,1,2)[12] : Inf

ARIMA(0,1,1)(1,1,1)[12] : 1359.93

ARIMA(0,1,3)(1,1,1)[12] : 1356.525

ARIMA(1,1,1)(1,1,1)[12] : 1356.427

ARIMA(1,1,3)(1,1,1)[12] : 1358.675

Best model: ARIMA(0,1,2)(1,1,1)[12]

Series: ts(boxcox_z, frequency = 12)

ARIMA(0,1,2)(1,1,1)[12]

Coefficients:

ma1 ma2 sar1 sma1

-0.6662 0.2996 -0.3012 -0.4028

s.e. 0.0880 0.0997 0.1645 0.1751

sigma^2 = 4601: log likelihood = -671.9

AIC=1353.79 AICc=1354.32 BIC=1367.69fit4 <- forecast::auto.arima(ts(boxcox_z, frequency=12),

test = "adf",

seasonal = TRUE)lmtest::coeftest(fit4)

z test of coefficients:

Estimate Std. Error z value Pr(>|z|)

ma1 -0.666226 0.088010 -7.5699 3.734e-14 ***

ma2 0.299594 0.099683 3.0055 0.002652 **

sar1 -0.301227 0.164489 -1.8313 0.067058 .

sma1 -0.402808 0.175098 -2.3005 0.021421 *

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1- 최종선택 모형에 비해 aic나 분산이 조금 작지만 추가된 계수가 유의하지 않으므로 기존 모형 유지

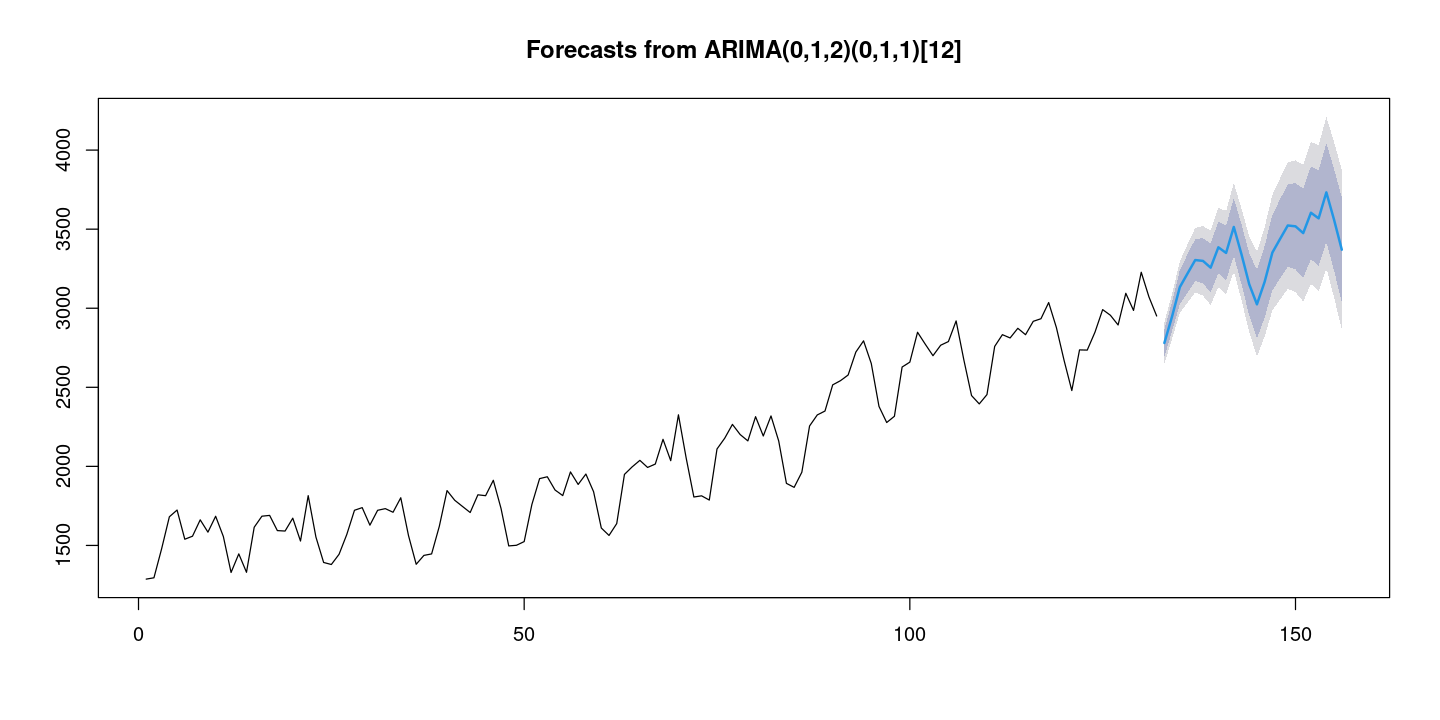

(9) 예측

fore_fit <- forecast::forecast(fit3, 24)fore_fit Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

133 2780.444 2693.821 2867.067 2647.966 2912.923

134 2948.470 2856.536 3040.404 2807.869 3089.071

135 3133.218 3025.951 3240.484 2969.168 3297.267

136 3219.609 3098.943 3340.275 3035.067 3404.151

137 3304.710 3171.991 3437.429 3101.734 3507.686

138 3299.345 3155.579 3443.110 3079.474 3519.215

139 3256.562 3102.541 3410.584 3021.007 3492.118

140 3385.280 3221.644 3548.916 3135.020 3635.540

141 3349.803 3177.087 3522.520 3085.657 3613.950

142 3514.000 3332.658 3695.342 3236.661 3791.339

143 3340.552 3150.976 3530.129 3050.621 3630.484

144 3151.776 2954.309 3349.243 2849.776 3453.776

145 3024.749 2808.612 3240.886 2694.196 3355.302

146 3167.091 2940.850 3393.332 2821.085 3513.096

147 3351.838 3113.152 3590.525 2986.799 3716.878

148 3438.230 3187.715 3688.744 3055.101 3821.358

149 3523.330 3261.522 3785.139 3122.929 3923.732

150 3517.965 3245.330 3790.601 3101.005 3934.925

151 3475.183 3192.134 3758.231 3042.298 3908.068

152 3603.901 3310.809 3896.992 3155.656 4052.145

153 3568.424 3265.622 3871.226 3105.329 4031.519

154 3732.621 3420.411 4044.831 3255.137 4210.105

155 3559.173 3237.830 3880.516 3067.721 4050.625

156 3370.397 3040.173 3700.620 2865.363 3875.430plot(fore_fit)

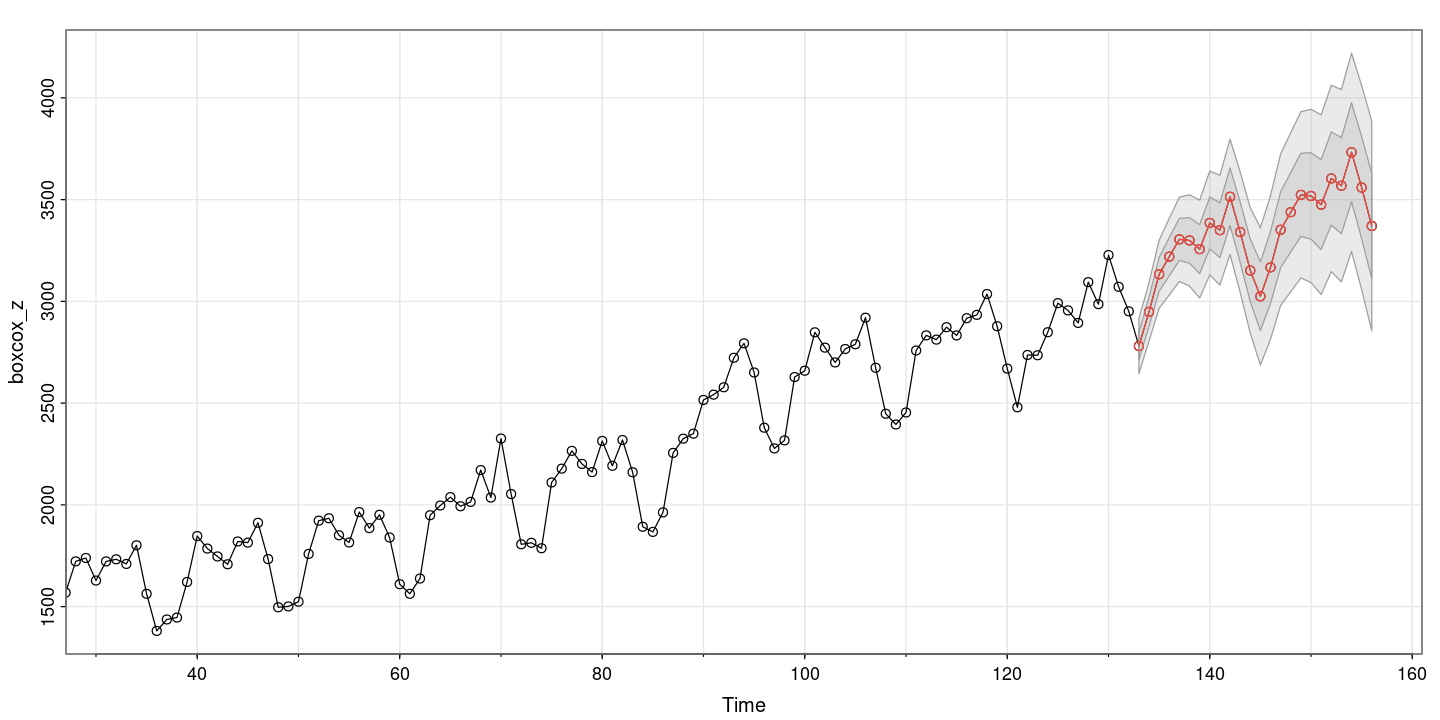

astsa::sarima.for(boxcox_z, 24, p=0,d=1,q=2,P=0, D=1, Q=1, S=12)- $pred

- A Time Series:

- 2780.44436470219

- 2948.46998834967

- 3133.21762076667

- 3219.60898627558

- 3304.70977212127

- 3299.34452206601

- 3256.56216204148

- 3385.27998378987

- 3349.80343457582

- 3514.00009457812

- 3340.55249656353

- 3151.77616396455

- 3024.74890238384

- 3167.09058936517

- 3351.83822178217

- 3438.22958729108

- 3523.33037313677

- 3517.96512308151

- 3475.18276305698

- 3603.90058480537

- 3568.42403559132

- 3732.62069559362

- 3559.17309757903

- 3370.39676498005

- $se

- A Time Series:

- 67.5921986216549

- 71.7366048879261

- 83.7002434641541

- 94.1558337596387

- 103.56114766584

- 112.180664914328

- 120.183575646675

- 127.685872866368

- 134.771185362014

- 141.502164923051

- 147.927188006552

- 154.084448753493

- 168.65253754947

- 176.536749601591

- 186.248055942822

- 195.47749928004

- 204.290398958884

- 212.738528453326

- 220.863749560442

- 228.700481527725

- 236.277431490681

- 243.61883960884

- 250.745395555351

- 257.67482381548

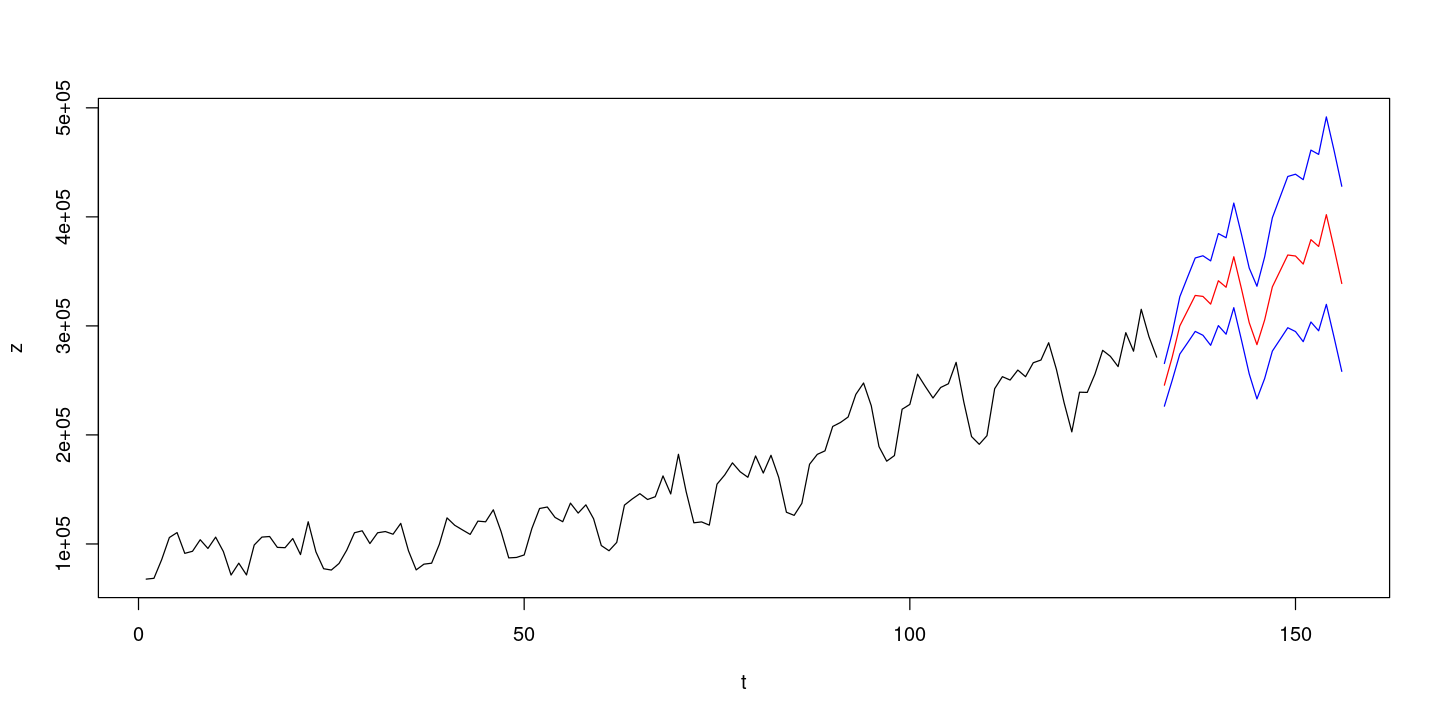

- BoxCox 역변환을 해야함

forecast_z = forecast::InvBoxCox(fore_fit$mean, lambda=forecast::BoxCox.lambda(z))

forecast_z- 245634.162066875

- 270964.342935491

- 299958.645281666

- 313921.348143813

- 327924.364184853

- 327034.276934031

- 319971.637075569

- 341407.634183245

- 335443.762145745

- 363399.977817667

- 333895.570293801

- 302936.523527017

- 282791.718952908

- 305402.76421357

- 335784.680882732

- 350387.36379716

- 365015.52063737

- 364086.17223163

- 356709.739667013

- 379085.979444533

- 372864.107784763

- 402007.344466243

- 371248.497707336

- 338900.503978254

forecast_z_upper95 = forecast::InvBoxCox(fore_fit$upper[,2], lambda=forecast::BoxCox.lambda(z))

forecast_z_lower95 = forecast::InvBoxCox(fore_fit$lower[,2], lambda=forecast::BoxCox.lambda(z))plot(1:(length(z)+24), c(z, forecast_z_upper95), type='n', xlab='t', ylab='z')

lines(1:length(z),z)

lines((length(z)+1) : (length(z)+24), forecast_z, col='red')

lines((length(z)+1) : (length(z)+24), forecast::InvBoxCox(fore_fit$lower[,2], lambda=forecast::BoxCox.lambda(z)), col='blue')

lines((length(z)+1) : (length(z)+24), forecast::InvBoxCox(fore_fit$upper[,2], lambda=forecast::BoxCox.lambda(z)), col='blue')

Simulation

# astsa::sarima.sim(ar = NULL, d = 0, ma = NULL, sar = NULL, D = 0, sma = NULL, S = NULL,

# n = 500, rand.gen = rnorm, innov = NULL, burnin = NA, t0 = 0, ...)

# sarima::sim_sarima(model=list(ar,iorder,ma, sar, siorder, sma, nseasons, sigma2),

# n = NA, rand.gen = rnorm, n.start = NA, x, eps,

# xcenter = NULL, xintercept = NULL, ...)### ARIMA(p,d,q)(P,D,Q)_s

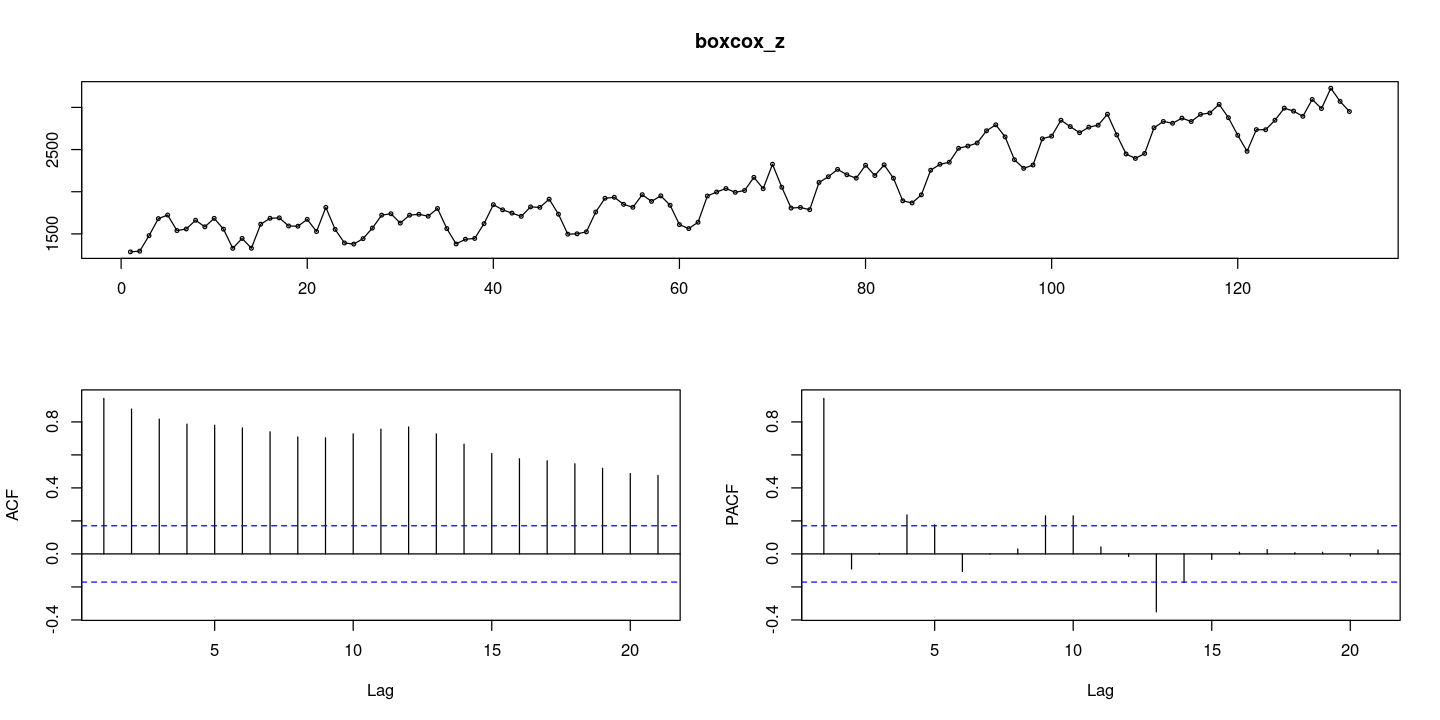

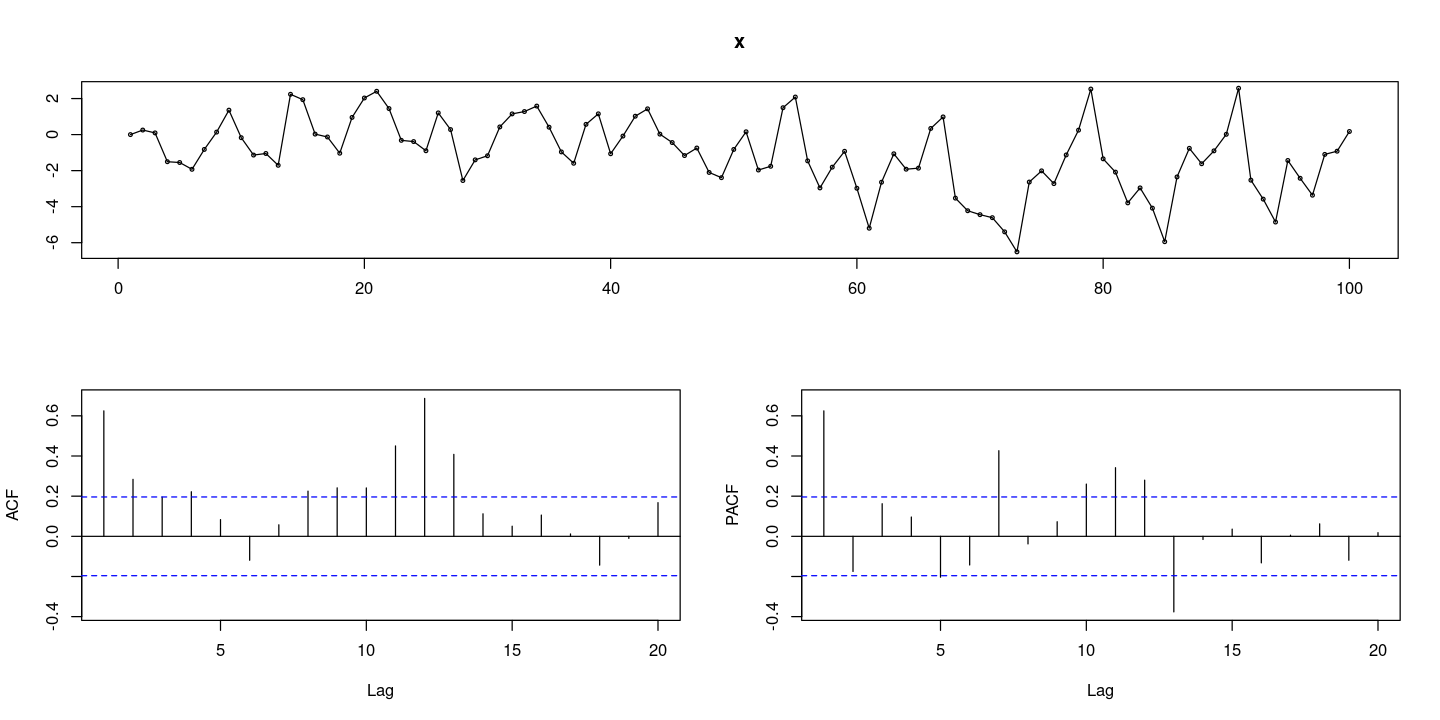

x <- sarima::sim_sarima(n=100, n.start=12,

model=list(ar = 0.7, siorder=1, nseasons=12, sigma2 = 1)) # SMA(1)

forecast::tsdisplay(x)

x <- astsa::sarima.sim(ar = 0.5, d = 1, ma = 0.1, sar = 0.1, D = 1, sma = 0, S = 12, n = 100)

forecast::tsdisplay(x)